Authored by Mr Ku the property expert, this book presents an essential guide for readers to amplify their investment gains. In a textbook style justified by facts and data, Mr Ku shares ...

Building Your Real Estate Riches – Ku Swee yong

Authored by Mr Ku the property expert, this book presents an essential guide for readers to amplify their investment gains. In a textbook style justified by facts and data, Mr Ku shares ...

The New York Times best-selling Freakonomics was a worldwide sensation, selling over four million copies in thirty-five languages and changing the way we look at the world. Now, Steven D. Levitt and Stephen J. Dubner return with SuperFreakonomics, and fans and newcomers alike will find that the freakquel is even bolder, funnier, and more surprising than the first.

Four years in the making, SuperFreakonomics asks not only the tough questions, but the unexpected ones: What's more dangerous, driving drunk or walking drunk? Why is chemotherapy prescribed so often if it's so ineffective? Can a sex change boost your salary?

SuperFreakonomics challenges the way we think all over again, exploring the hidden side of everything with such questions as:

How is a street prostitute like a department-store Santa?

Why are doctors so bad at washing their hands?

How much good do car seats do?

What's the best way to catch a terrorist?

Did TV cause a rise in crime?

What do hurricanes, heart attacks, and highway deaths have in common?

Are people hard-wired for altruism or selfishness?

Can eating kangaroo save the planet?

Which adds more value: a pimp or a Realtor?

Levitt and Dubner mix smart thinking and great storytelling like no one else, whether investigating a solution to global warming or explaining why the price of oral sex has fallen so drastically. By examining how people respond to incentives, they show the world for what it really is – good, bad, ugly, and, in the final analysis, super freaky.

Freakonomics has been imitated many times over – but only now, with SuperFreakonomics, has it met its match.

The definitive inside account of the "extraordinary" (Financial Times) 1MDB scandal, "a true life thriller" (Ben Mezrich) about a "modern Gatsby" who managed to swindle

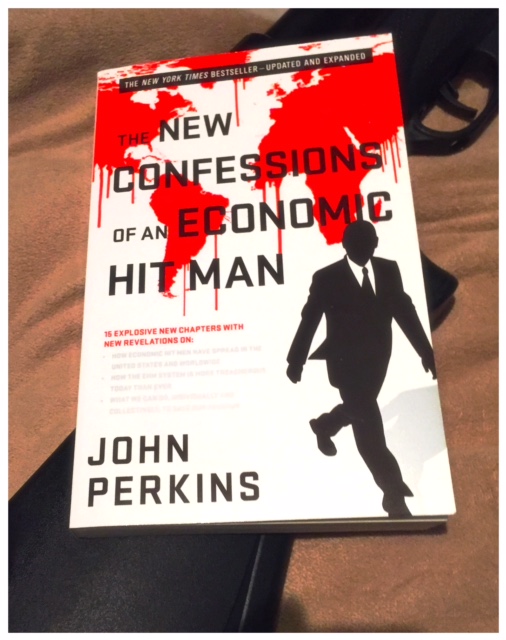

Personally I think business is just business, where willing parties cut deals together. The author describes his career in Seychelles, Honduras, Ecuador, Libya, Turkey, Western Europe, Vietnam, China, and, in perhaps the most unexpected and sinister development, the United States, where new EHMs

Originally published: April 6, 2010 Author: David Remnick Page count: 672 Publisher: Alfred A. Knopf Nominations: Goodreads Choice Awards Best History & Biography Review: The Bridge refers to the police attack on demonstrators at at Edmund Pettus Bridge in 1965, during the marches of Selma to Montgomery. Some viewed as a bridging […]

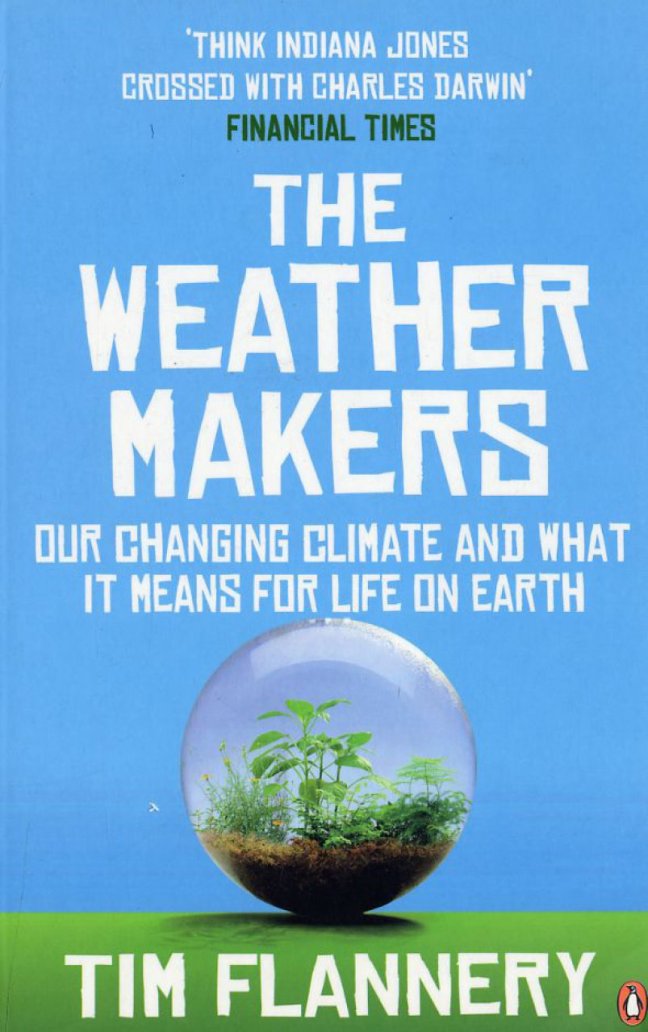

One of our favourite books of 2006

The Weather Makers tells the dramatic story of the earth's climate, of how it has changed, how we have come to understand it, and of what that means for the future. Tim Flannery's gripping narrative takes the reader on an extraordinary journey into the past and around the globe, bringing us closer to the science than ever before. Along the way he explodes the many illusions that have grown up around this subject.

The most successful may not always be the smartest or hardest working. A myriad of factors such as culture, family, generatio......

In this fast-paced, example-packed, sometimes darkly hilarious book, journalist Dan Gardner shows how seminal research by UC Berkeley professor Philip Tetlock proved that pundits who are more famous are less accurate — and the average expert is no more accurate than a flipped coin. Gardner also draws on current research in cognitive psychology, political science, and...........

Fresh from Oxford with a degree in philosophy and no particular interest in business, Matthew Stewart might not have seemed a likely candidate to become a consultant. But soon, he was telling veteran managers how to run their companies.

Striking fear into the hearts of clients with his swift, sharp analytical tools, Stewart lived in hotel rooms and got fat on expense account cuisine – until finally, he decided to turn the consultant’s merciless, penetrating eye on the whole management industry itself – the business schools, the consultancies, the gurus, and those lavishly compensated CEOs.

How do so many who know so little make so much by telling other people how to do the jobs they are paid to know how to do? Why do people pursue expensive graduate degrees that have no demonstrable effect on their performance? Why do so many bad books of management advice sell so well? How can I get a job where I make millions in stock options and then leave my company in the dust?

Alongside his devastating critique of management “philosophy” from Frederick Taylor to Tom Peters, Stewart provides a bitingly funny account of his own days in an ethically-challenged management consulting firm.

Sorkin writes about the months after the sale of the Bear Stearns brokerage firm, up through the collapse of Lehman Brothers...and, finally, to "the bailout," or what government officials prefer to call "TARP"—Troubled Asset Relief Program. It was a desperate time, one which turned conventional politics on its head. Both parties—voting against their deepest-held beliefs—nearly nationalized the banks (say Republicans) or subsidized the wealthy (say Democrats).

What makes the story such fun—oh, yes, it's fun!—are portraits of outsized personalities—brilliant, driven men and women, who get where they've gotten by grueling work schedules, mentors, cut-throat infighting, alliances, and stunning betrayals.

In the days leading up to the bailout, we're privy to blow-by-blow accounts of these titans as they clash, curse, plead on bended knee, and wretch over toilet bowls. Finally, reluctantly, politicians, government officials, and bankers forge an agreement.

There are no particular villains but plenty of arrogance, blindness, and irresponsibility to go around. There are, however, heroes—Henry Paulson and his team at Treasury; Timothy Geitner, then head of NY-Federal Reserve; and Ben Bernanke, Federal Reserve chairman.

This is an ambitious undertaking for any book club. But if you're up to it, Too Big Too Fail is an extraordinary tale about how close, how very close, we came to a total global meltdown.